What do IR35 changes mean for recruitment agencies?

Note:

As of the 17th of October 2022, the IR35 rules as announced in 2018 will continue to hold into 2023 and beyond. The latest related announcement from the UK government on this topic is examined by the Evening Standard in this link

—

(This article was originally published 8th March 2019 and updated in October 2022)

The government announced in 2018’s Budget that private sector businesses will become responsible for assessing the employment status of the off-payroll (commonly known as IR35) workers they engage.

From 6 April 2021, medium and large private sector businesses will need to decide whether individuals who work through their own company fall inside or outside of IR35.

Where the worker is inside IR35, the business, agency, or third party paying the worker’s company will need to deduct income tax, employee National Insurance (NI) and pay employer NI.

This article highlights what a recruiter needs to know about existing IR35 legislation and what the proposed changes mean for the private sector.

What is IR35?

The off-payroll working rules – commonly known as IR35 – is designed to combat tax avoidance by workers supplying their services to clients via an intermediary, such as a limited company. However the worker would be classed as an employee if an intermediary is not used.

HMRC refers to such workers as ‘disguised employees’ as the worker doesn’t meet HMRC’s definition of self-employment. Therefore, the correct tax and NI isn’t paid correctly.

The rules to counter alleged tax avoidance via the use of ‘personal service companies’ became law in 2000, and remain in place today.

Note: ‘worker(s)’ = freelancer / contractor

IR35 changes and the Public Sector

In April 2017, the responsibility for determining whether a PSC worker is inside or outside of scope of IR35 legislation was shifted to the hiring organisation. This included liability for tax and national insurance contributions.

Public authorities impacted include:

- Government departments and their executive agencies

- companies owned or controlled by the public sector

- schools and universities

- local authorities

- NHS

What was the impact?

Released in 2018, HMRC’s Off-Payroll Reform in the Public Sector report found:

- 58% of central bodies and 70% of sites said that there was no change in the ability to fill contract vacancies post April 6 2017.

- Most public bodies reported that their ability to fill contract vacancies had not changed.

- Most central bodies and sites had not found it any more difficult to recruit off payroll contractors with the appropriate skills or knowledge (central bodies: 68%, sites: 76%) or find off-payroll contractors willing to work for them (central bodies: 62%, sites: 67%).

- 38% of public bodies used HMRC’s CEST / ESS tool as a source of information for determining IR35 status. Of these, 22% said that the tool was either “not very helpful” or “not at all helpful”.

- 60% of central bodies reported that their staff spend more time on administration since the changes.

Proposed IR35 changes in the Private Sector, April 2021

The Government’s objective is to increase compliance in the private sector. But with the rules that have been in place since 2000, to make sure that they operate as intended.

Consequently, the proposed changes to IR35 will impact businesses in the recruitment sector who supply workers operating through intermediaries, such as PSCs, as well as medium and end user clients who use the services of ‘off-payroll’ workers.

Why?

- To increase compliance with the existing off-payroll working rules in the private sector

- HMRC estimates that only 10% of people working in this way apply the rules properly

- The cost of non-compliance in the private sector is growing and is estimated to reach £1.2bn a year by 2022

Who is impacted by the IR35 changes:

- Recruitment agencies who supply workers operating through intermediaries, such as PSCs

- Medium to large businesses who are using the services of ‘off payroll’ workers.

- The worker

Key areas of the proposed changes

- From 6 April, 2021, the responsibility for assessing whether IR35 applies will shift from the individual to the end client. (If the role is determined to be ‘inside’ IR35, whoever the fee payer is will be responsible for deducting the relevant Tax and NI contributions at source, before paying the Limited Company the Net amount.)

- The new rules will only apply to ‘medium and large businesses’. The criteria is expected to be similar to the definition in the Companies Act 2006 which stipulates “the qualifying conditions are met by a company in a year in which it satisfies two or more of the following requirements:”

- Turnover not more than £10.2 million;

- Balance sheet not more than £5.1 million; and

- No more than 50 employees

Note: The Companies Act definition doesn’t apply to unincorporated businesses. HMRC suggests two options – to apply the reform to “unincorporated entities with 50 or more employees and to entities with turnover exceeding £10.2 million” or “to apply the reform only to unincorporated entities that have both 50 or more employees and turnover in excess of £10.2 million.” While it falls on clients to know whether they’re a small organisation, questions have been raised around when workers should be told they’re working for one.

- The government has announced that small organisations will be exempt from the changes proposed for April 2021. Meaning that workers engaged in contracts with ‘small businesses’ will remain responsible for determining IR35 and not the client. HMRC confirmed in their March 2019 consultation that this will remain the case even if the worker is hired via a recruitment agency.

- For workers whose assignments will fall inside IR35, PAYE and NI contributions will need to be deducted at source from their income by the ‘fee payer’ (agency or end client).

- The end client is advised to communicate to the worker the IR35 status of their assignment.

- Provided that everyone in the supply chain fulfils their responsibilities, the ‘fee payer’ will carry the liability.

IR35 tax simplified

- Inside = contractors should be paying employed levels of tax.

If continuing to use a Limited Company, the Fee Payer will have to deduct Tax & NI before paying the Limited Company the Net amount or the contractor will need to use an Umbrella.

If providing services via an Umbrella, the contractor will be setup on PAYE and employed by the umbrella. Therefore these changes won’t apply.

- Outside = contractors can pay themselves a combination of salary and dividends which can be more tax efficient.

In this scenario, the fee payer can continue to pay the Limited Company the Gross payment as before with no changes to taxation.

Determining IR35 status

IR35 decisions are based on but not limited to:

- Mutuality of obligation

- Personal service

- Direction and control from the client

- Substitution

- Treated as a permanent employee of that organisation

HMRC has developed the Check Employment Status for Tax (CEST) service to help businesses determine whether the off-payroll working rules apply.

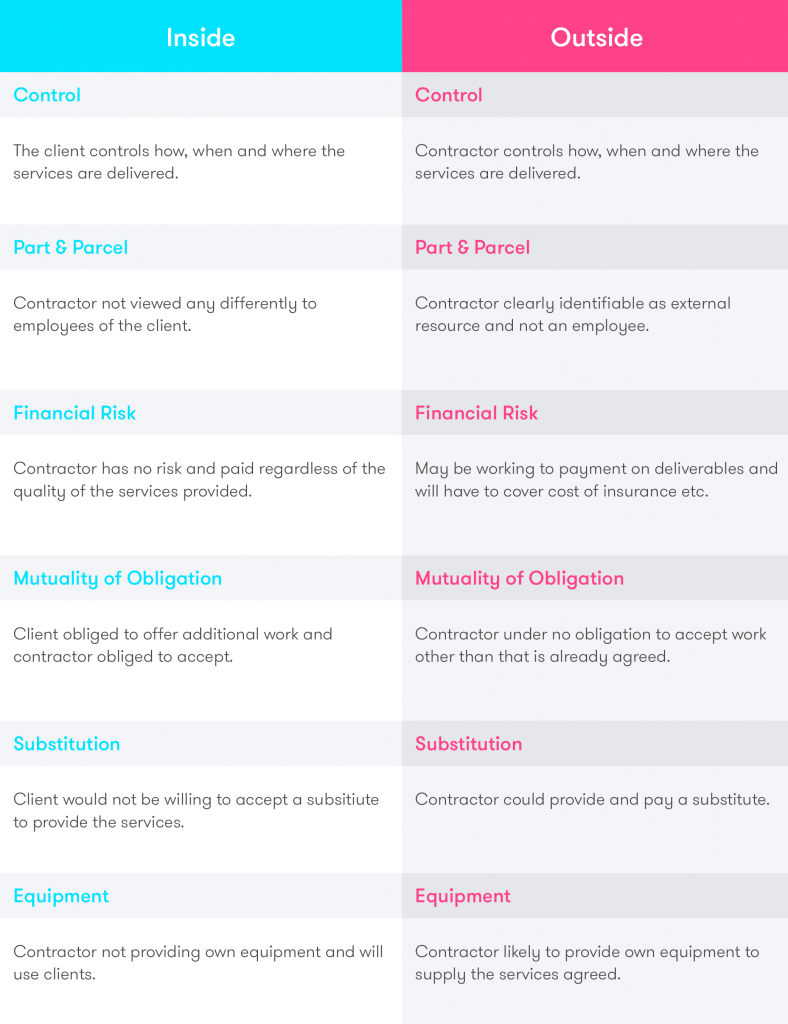

‘Inside’ or ‘outside’ IR35 at a glance

Client responsibility

Clients will have to make the IR35 determination on any flexible worker that they engage with from April 2021, or any contracts that are in place before and have an end date beyond 2021.

Reasonable care

Post changes to IR35 in the Public Sector, in April 2017, many public sector bodies applied blanket ‘inside’ decisions. However, this step was deemed to be unnecessary by HMRC, who quickly introduced ‘reasonable care’.

HMRC defines reasonable care as “doing everything you can to make sure the … documents you send to HMRC are accurate”. Additionally it states that it will take “individual circumstances into account when considering whether you’ve taken reasonable care”.

As a result, it’s advisable for clients to have a standardised approach to defining inside or outside IR35.

Umbrella Company Contractors

Anyone supplying services using an Umbrella does not fall into the legislation. This is because they are employed by the Umbrella Company and the relevant Income Tax and NI contributions are paid in the same ways as any traditional employee.

Summary of proposed IR35 changes in the Private Sector

- New rules apply to private sector from April 2021

- End client is responsible for determining IR35 status

- Small clients are excluded from the new rules

- End clients have a duty of ‘reasonable care’ when making determination

- End client to supply a Status Determination Statement citing reasons for decision

- Client Led Status Disagreement process in place, whereby contractor can challenge status. The client has 45 days to respond

- If the contractor is inside IR35 then the Fee Payer must deduct Tax and NI payments

- Debt liabilities can pass back up the supply chain

What recruitment agencies should do in preparation for 2021 proposed IR35 changes in the private sector

- Assess current arrangements for each client, identifying the number of workers supplied who operate via ‘off-payroll’ status – e.g. PSCs.

- Determine if the off-payroll rules apply for any contracts that will extend beyond April 2021.

- Start talking to your contractors about whether the off-payroll rules apply to their role.

- Put processes in place to determine if the off-payroll rules apply to future engagements. These might include who in your organisation should make a determination and how payments will be made to contractors within the off-payroll rules.

- Assess arrangements involving complex labour supply chains to identify if your position post April 6 2021 will increase your payment risk.

- Identify how many clients are outside the new rules through not meeting the criteria to be classified as a ‘medium and large business’.

- Develop a training and communications strategy to ensure your team can explain changes to IR35 to workers who are ‘inside’ or ‘outside’ the legislation.

- Assess the direct / indirect financial impact of IR35.

- Review internal systems, such as payroll software, process maps, HR and onboarding policies to see if they need to make any changes

What’s next?

From April 2021 the implementation of the IR35 legislation in the private sector is mandatory. Before these changes, clients receiving a worker’s service must comply with the off-payroll working rules to ensure they are not affected.

Some clients must complete a simplified test to see if the business meets the requirements for the IR35 changes. Most importantly, clients must apply the rules at the start of the new tax year, 6th April 2021.

Recommended reading

Specialist advice can be sought from a variety of tax, legislation and employment experts including: