Invoice Discounting

Invoice discounting is a finance facility used by businesses to leverage the value of their sales ledger and get an advance on outstanding invoices. This allows businesses to increase cash flow and access up to 100% of their receivables by using their unpaid invoices as collateral.

It’s the simplest way to benefit from invoice financing because you remain in charge of collecting the payment from your clients whilst the lender simply advances the cash.

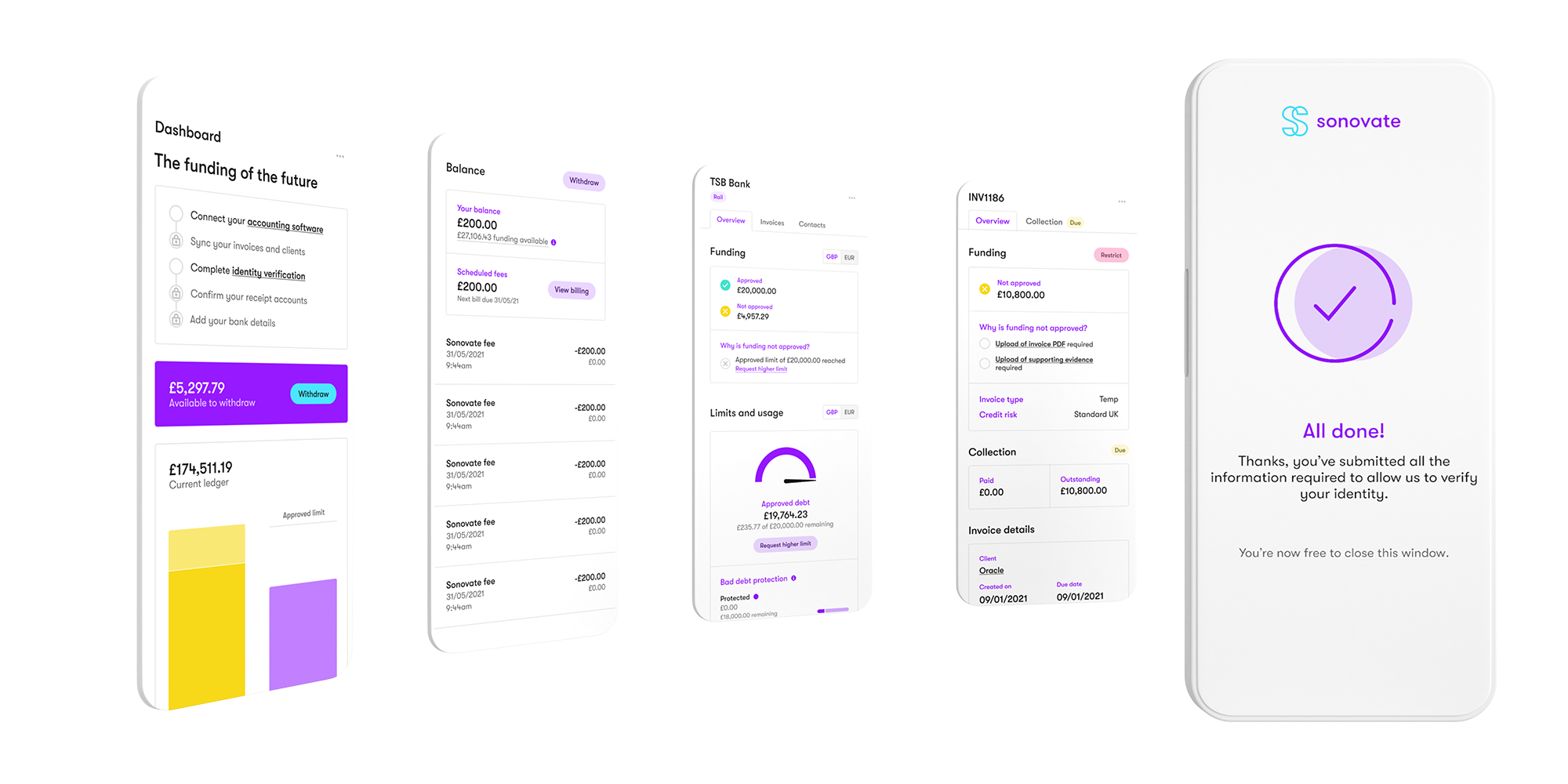

Sonovate makes this easy — we do that hard work so you can focus on growing your business.