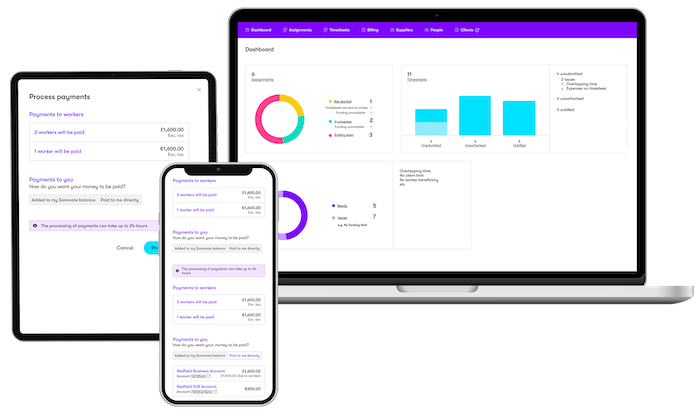

Funding platform for recruitment, consultancies & labour marketplaces

Revolutionise invoice funding

Is your recruitment agency or consultancy seeking a flexible business finance solution? Are you worried about late payments from your clients or cumbersome processes to get funding and loans from banks and other lenders? You’ve come to the right place!