Industry leading invoice funding and workflow automation

Cutting edge technology and expert support

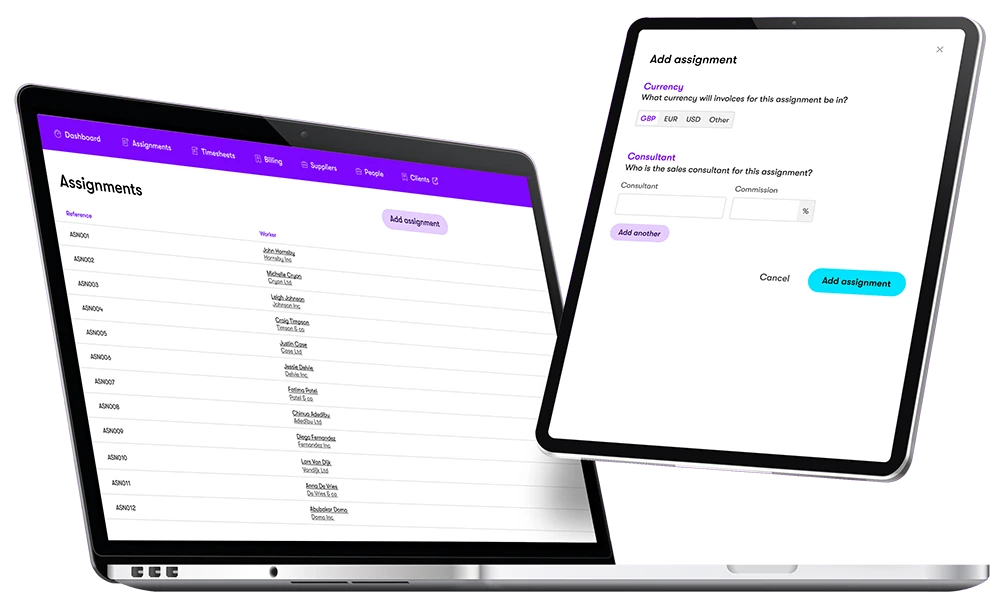

We’ll fund your permanent and contractor placements, but we’ll also do a lot more. Our state of the art platform is built with you in mind. To help you manage your finances and speed up your operations, we allow you to synchronise with your accountancy software so you stay on top of your invoices, payments, dunning and collections.

We also automate timesheets, allowing you to send them to workers at the click of a button and monitor them all the way through submissions, approvals and payments. Our platform does it all, and we’ll let you know if and when you need to take action.