UK recruitment industry growth 2008 – 2018

Since 2008, the number of recruitment agencies operating in the UK has grown on average 27% per year.

How the recruitment industry continues to go from strength-to-strength owes much to its ability to embrace change and maximise its unique position during periods of economic uncertainty.

With the Recruitment and Employment Confederation (REC) predicting that 56% of vacancies in the next 12 months will be filled by agencies, the role of the recruiter is pivotal.

From the obvious (high-employment) to less obvious (recession periods), this article looks at some of the factors behind the recruitment industries continued growth over the last decade.

Chart: New recruitment agency startups by year

Source: Companies House

Flatlining growth during the recession gave way to a sharp increase in recruitment startups. A combination of record employment, lower barriers to entry and digitalisation is making recruitment more attractive than ever.

- A total of 32,886 agencies entered the market since 2008.

- In 2017, Companies House recorded the launch of 5,824 new recruitment agencies

- Over 115,000 people are employed in the industry

Recruitment growth during the recession

2008’s global financial crisis triggered a sharp rise in unemployment, peaking at 2.7 million in 2011, up from 1.6 million in 2008, the highest level for 17 years in the UK.

With the fallout impacting all industries, the knock-on effect was felt by recruitment but not as acutely as first forecasted. Between 2008 and 2010, UK recruitment industry turnover dropped 15% before rebounding to grow by 25% in 2011.

As the grip of the finance crisis tightened, high unemployment led to an influx of CVs on the market. At a time when identifying individuals with the right skills was critical, many businesses found it difficult to recruit the skills they needed.

Recruiters with focused networks and a deep understanding of client requirements were able to pinpoint the right hires without delay.

Overall, the recruitment industries unique position enabled it to weather the storm and increase value as the job market remained depressed into 2011.

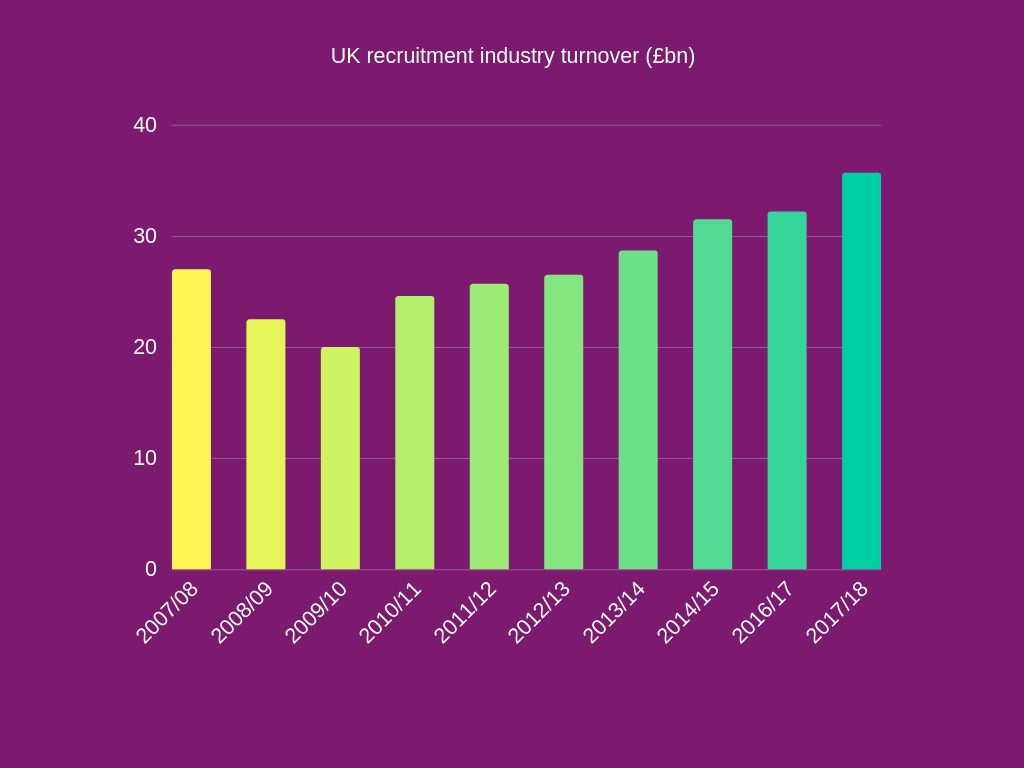

Chart: UK recruitment industry turnover (£bn)

Source: Recruitment & Employment Confederation (REC) industry trends report

Recruitment industry turnover averages £27bn per year. Remaining depressed from 2008-10, recruitment grew strongly, exceeding 2007/08’s level by 2013/14 and accelerating year-on-year thereafter.

Recruitment industry growth in a new working world

After the financial crisis came growth, but only this time the growth was different.

Public distrust in the corporate machine and rapid digitalisation provided fertile ground for new tech industries. A new generation of media savvy individuals were entering the job market, shunning the conventional 9-5. And a new breed of worker began transforming the ‘working world’.

Each of these presented opportunities and challenges for recruitment:

- Fintech (Financial Technology) created a new era of banking, removing barriers to entry, complexity and cost.

- By 2017, 32 million people were employed, compounding skills shortages.

- Millennials on average stay within a role for a maximum of three years. The recruiter’s role as an intermediary and advisor became more pronounced.

- Rise of the gig economy provides organisations with access to on-demand, specialised expertise. McKinsey & Co reported in 2016 that up to 162 million people in Europe and the US engaged in some form of independent work.

- In 2017, the ONS reported that 15% of the working population were self-employed, totalling 4.88 million people.

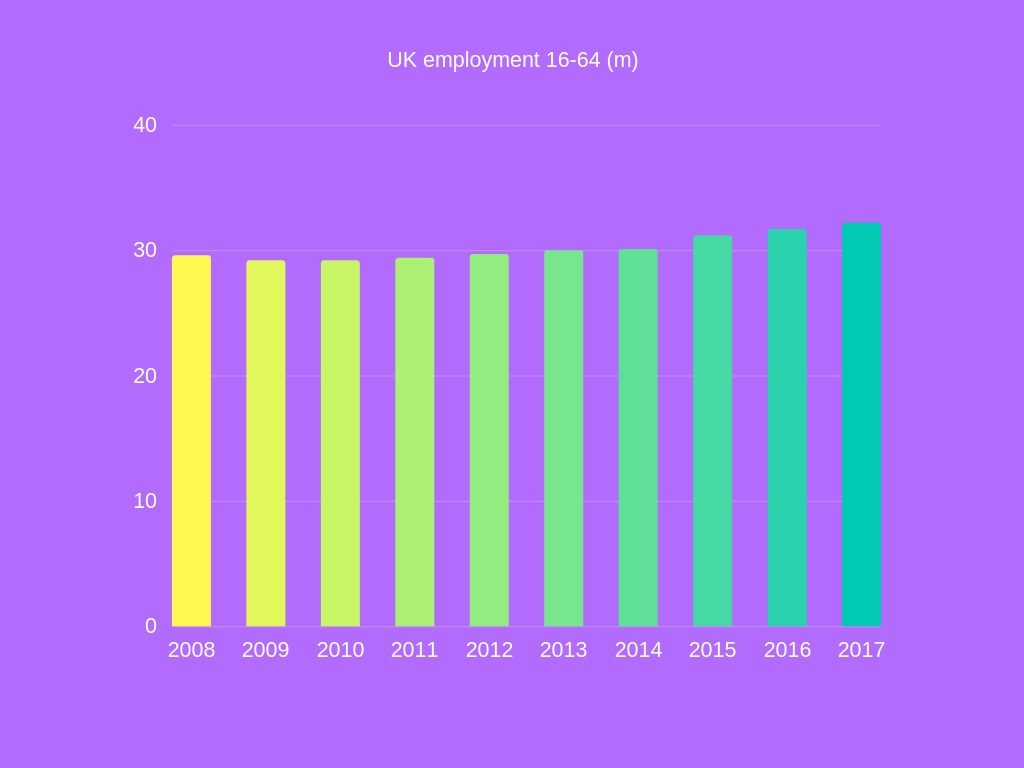

Chart: UK employment 16-64 (m)

Source: ONS

In the UK, the unemployment rate increased from 5.4% in 2007 to 8.1% in 2011. In 2018, the number and proportion of people in work remains close to record levels despite some predictions that unemployment would rise following the Brexit vote.

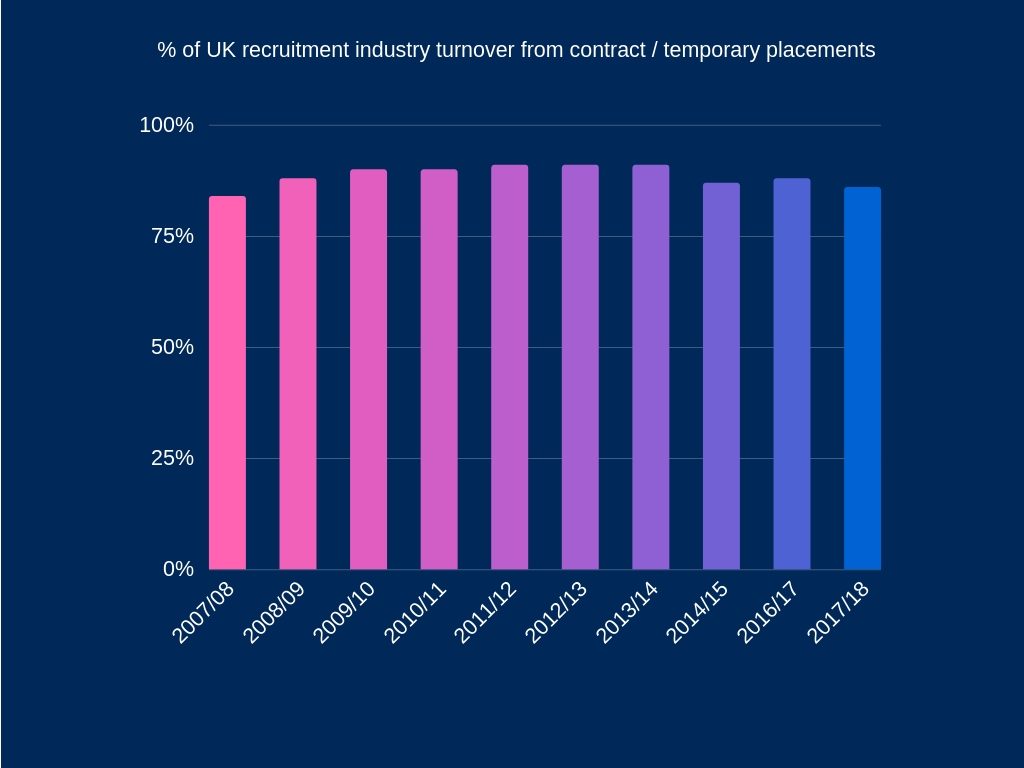

Chart: % of UK recruitment industry turnover from contract / temporary placements

Source: REC

Since 2007, on average 89% of the UK recruitment industry turnover is comprised of contract and temporary placements.

In 2017/18, total revenue from permanent and temporary placements reached £35.7 billion. £30.8 billion was generated from temporary placements while approximately £4.9 billion was generated through permanent placements.

**Note: Since 2014, REC’s recruitment industry trend report also accounts for organisations providing managed service programmes (MSPs) and recruitment process outsourcing services (RPOs). This means data is not directly comparable to previous years.**

Are you looking to enter the world of contract recruitment?

Covering market stats, what KPIs work best, insurance, IR35 and more! our ebook covers everything you need to know about contract recruitment.

Embracing tech to enable recruitment industry growth

Recruitment has always embraced technology, adopting it early to connect with people, faster and more efficiently than before. According to Deloitte, the talent acquisitions systems market boasts over 400 competitive solutions for hiring, and continues to show growth of 10-12% per year. The market for corporate solutions alone is now over $1.5 billion in size.

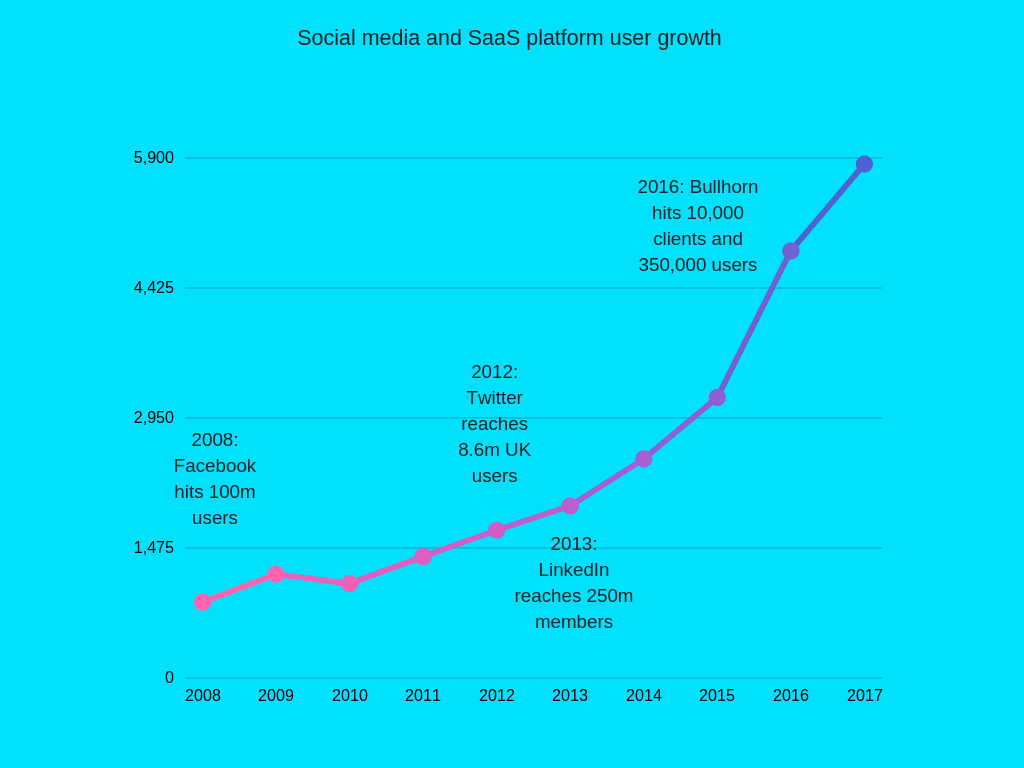

Chart: Social media and SaaS platform growth

Source: Facebook, LinkedIn, Twitter, Bullhorn

As the world became more connected, social and networking platform growth accelerated. For recruitment, the ability to engage with individuals and raise brand awareness at a reduced cost provided enormous benefit.

Social media is now part of everyday life – research conducted by the Society for Human Resource Management found that 84% of businesses use social media for recruiting, compared to 56% in 2011.

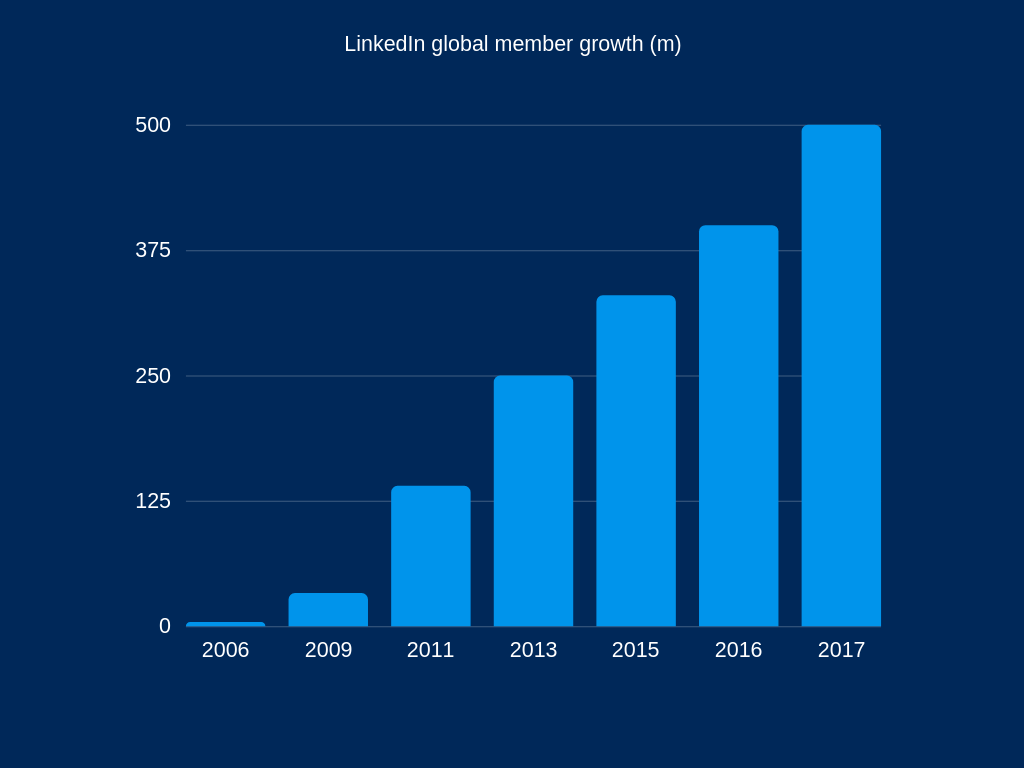

Chart: LinkedIn global member growth (m)

Source: LinkedIn

LinkedIn is somewhat rare as it monitises both sides of the two-sided marketplace (members and recruiters) it serves. LinkedIn’s preference for releasing paid features (InMail*) and working with members to fine tune features, before monetising when demand is high, has cemented its place as the number one professional network.

*As one of their first features, LinkedIn released InMail as a paid option.

Reduced barriers to finance increased growth in recruitment agencies

9,565 recruitment firms reported an annual turnover of more than £250,000 in 2017. Access to cash flow is vital for businesses. Without liquidity, a firm cannot pay its staff and other expenses, faces high bank charges and misses out on growth opportunities.

The financial crisis was a watershed moment. Since 2011, increased scrutiny, digital connectivity and new regulations enabled a wave of businesses to create the finance people wanted access to. In 2018, recruitment businesses can choose from more finance providers than ever to kickstart and grow their business.

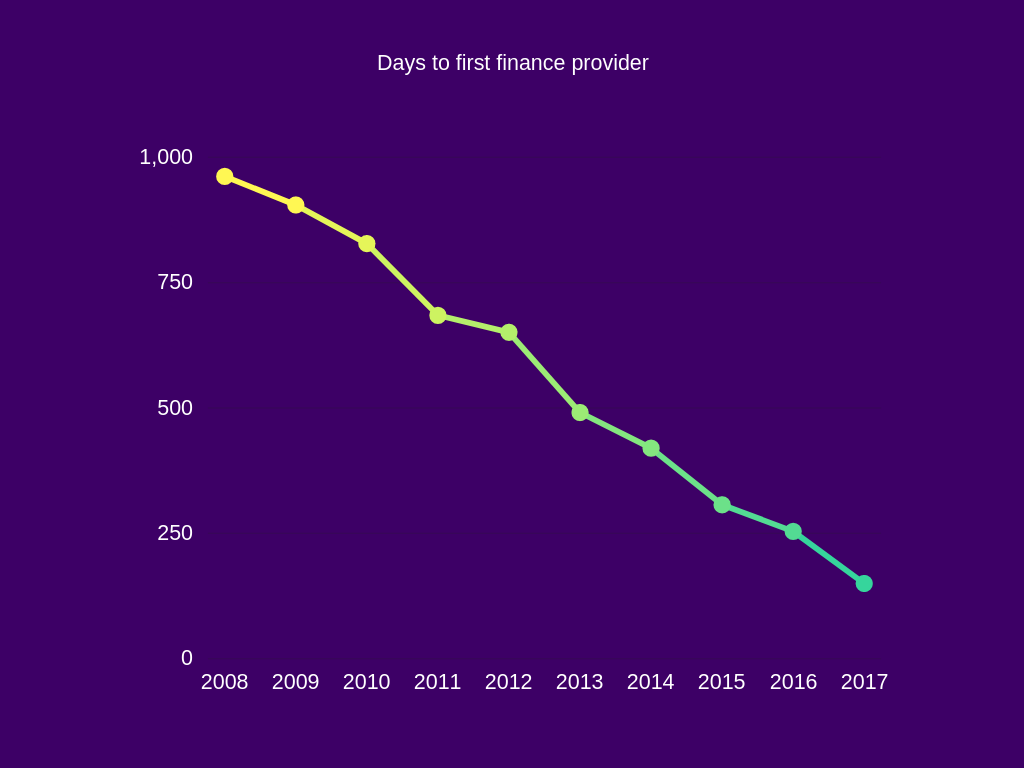

Chart: Days to first finance provider

Source: Companies House

As finance evolved, the barriers to entry reduced. No longer would finance be out of reach or littered with stringent conditions for startups and SMEs to scale faster. Fintech has simplified processes and made it easier for B2B and B2C consumers to get the finance they need. Today, businesses have more choice than ever and the pace of investment is accelerating. In 2018, the global Fintech investment hit a record $111bn, according to the KPMG Pulse of Fintech report.

Final thoughts on recruitment growth

Irrespective of how good a job market is, if you’re not executing on the core principles; segmentation, targeting and communication, it doesn’t matter how much tech or finance you have. Top businesses adapt to change and utilise the best tools to increase productivity and achieve greater results.

As machine learning and AI platforms continue to develop, the next decade will hopefully see an increase in ‘recruitment automation’.

Recruitment is a human activity, the more time a recruiter spends talking to people and letting the machine do the work, the more each stakeholder will get out of the process.

*****

Notes:

Audrey Freedman proposed the phrase “contingent work” in 1985. Defined as “conditional and transitory employment arrangements as initiated by a need for labour usually because a company has an increased demand for a particular service or a product or technology, at a particular place, at a specific time.”

The Staffing Industry Analysts (SIA) has two main classifications for the ‘gig economy’:

- The ‘sharing economy’ includes companies such as Airbnb and Zipcar.

- The ‘gig economy’ includes the human cloud, as well as temporary agency work, independent contractors and statement of work (SOW) consultants.

In the United Kingdom and all other EU member states, a recession is defined as two successive quarters of negative economic growth, as measured by the seasonally adjusted quarter-on-quarter figures for real GDP.