Invoice funding for fast growing businesses

Manage funding across countries and offices

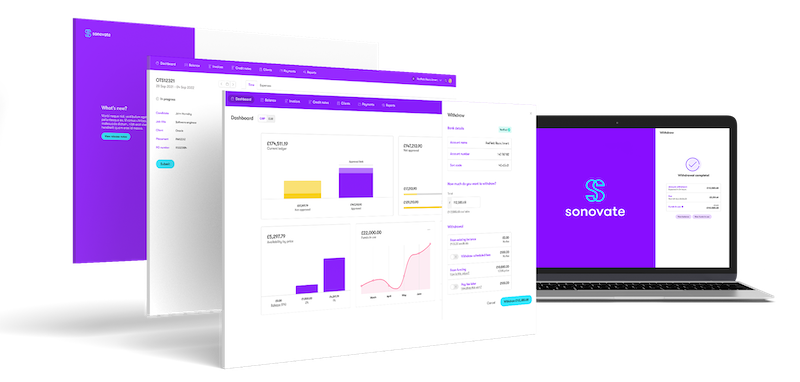

State of the art reconciliation, reporting and synchronisation to give you improved visibility on your finances across offices and countries. 95% bad debt protection as standard for added confidence that your business is protected.

Our multicurrency platform is designed to help you expand domestically and internationally, with resilient, highly available and scalable funding that grows with you. Plus, our cutting-edge tech helps you to sync with your accountancy software in real time, allowing you to be more efficient, make speedy decisions, and get started quickly.